Guideline: Creating a comprehensive export invoice

Creating a comprehensive export invoice is crucial for international trade, providing a clear record of the transaction and facilitating smooth customs clearance. Here's a guideline on the information typically required on a UK export invoice:

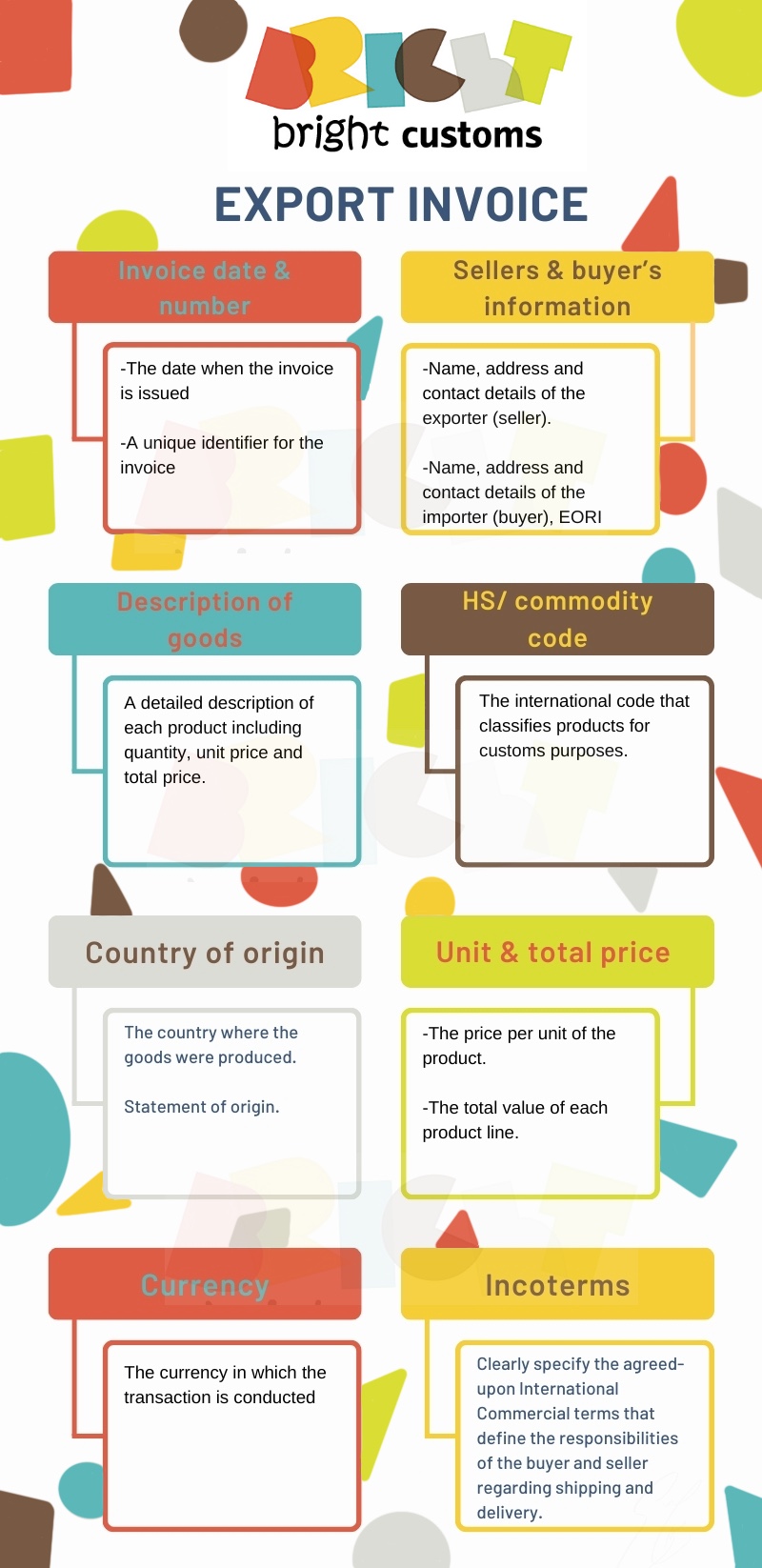

All information marked in orange is mandatory.

-

Header Information:

- Invoice Date: The date when the invoice is issued.

- Invoice Number: A unique identifier for the invoice.

- Seller's Information: Name, address, and contact details of the exporter (seller).

- Buyer's Information: Name, address, and contact details of the importer (buyer).

-

Product Description:

- Description of Goods: A detailed description of each product, including quantity, unit price, and total price.

- Harmonized System (HS) Code: The international code that classifies products for customs purposes.

- Country of Origin: The country where the goods were produced.

-

Pricing and Payment Terms:

- Unit Price: The price per unit of the product.

- Total Price: The total value of each product line.

- Currency: The curency in which the transaction is conducted.

- Incoterms: Clearly specify the agreed-upon International Commercial Terms that define the responsibilities of the buyer and seller regarding shipping and delivery.

-

Shipping Information:

- Port of Loading: The port where the goods are loaded onto the vessel.

- Port of Discharge: The port where the goods are unloaded from the vessel.

- Method of Shipment: Specify whether it's by sea, air, land, or a combination.

- Vessel/Flight Details: Provide details such as the name of the vessel or flight number.

-

Payment Information:

- Payment Terms: Clearly state the agreed-upon terms of payment (e.g., letter of credit, advance payment, open account).

- Bank Details: Include the exporter's bank details for payment.

-

Additional Charges:

- Shipping and Handling Costs: Specify any additional charges related to transportation.

- Insurance Costs: If applicable, include the cost of insurance for the shipment.

-

Customs Information:

- EORI Number: Economic Operator Registration and Identification number for customs clerance.

- VAT Number: If applicable, include the Value Added Tax registration number.

-

Declaration of Origin:

- Statement of Origin: Declare the origin of the goods as required by customs regulations.

-

Signatures and Certifications:

- Authorized Signatures: Signtures from authorized personnel representing both the exporter and the importer.

- Certificates: Attach any required certificates, such as a certificate of origin or phytosanitary certificate.

-

Terms and Conditions:

- Terms of Sale: Clearly outline the terms and conditions of the sale.

- Dispute Resolution: Specify the method of dispute resolution in case of conflicts.

It's very important to stay informed about any specific requirements for the destination country and industry-specific regulations. Always consult with customs authorities and trade experts for the most accurate and up-to-date information.

Polski

Polski Deutsch

Deutsch Slovenský

Slovenský български

български